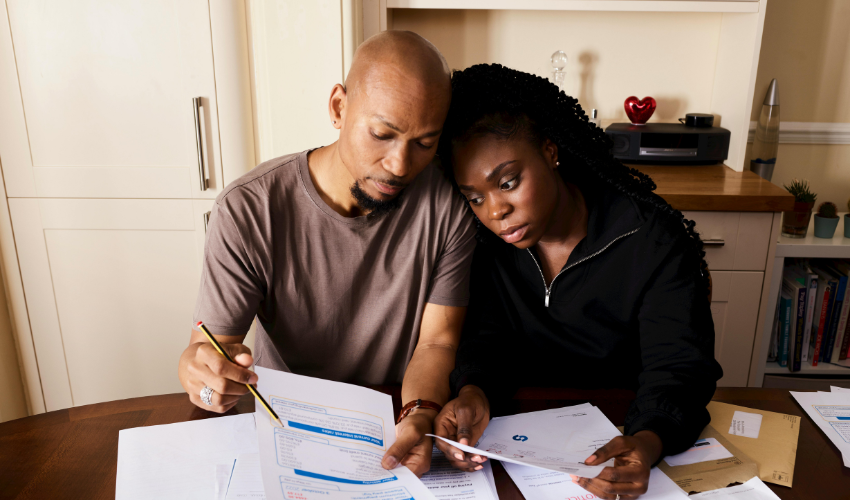

So, you’ve been to your GP and got a referral to a specialist. It’s looking like a hospital visit might be looming.

While you’ve invested in your health by getting private hospital cover to look after the worst of the expenses, you’re rightly concerned about the rest. You’ve heard stories of people paying over the odds for care they thought was covered. Out-of-pocket costs that Medicare and the health fund don’t cover.

What are out-of-pocket medical costs?

The fact is, the government sets out in the Medical Benefits Schedule (MBS) what it believes is an appropriate fee for medical services. As your insurer, we pay 25% of that fee (as well as your private hospital room and other costs) and Medicare pays the rest. At the same time, specialists, including anaesthetists and other medical providers involved in your hospital care, are free to charge what they believe is a fair for that service. Anything over the MBS fee is your out-of-pocket cost.

What can you do to make sure you’re not caught by surprise by unexpected medical costs?

Firstly, you can ask your GP to help by referring you to a specialist that charges moderate fees or has agreed in the past to work with health funds to keep costs for patients down. We call this Access Gap Cover and you can read more about it here.

You can also use the Healthshare database on that page to search for a participating specialist by name or the area of care you need. Ask your GP to check the specialist before making the referral.

Next, once you’ve got your specialist appointment and have an idea of the treatment or procedure you’ll be up for, you have the right to know what you’ll need to pay upfront before you receive any hospital treatment – and any out-of-pocket costs involved.

It’s important to ask the treating specialist and anyone else involved in your care to provide this in writing before you give the go-ahead for treatment. This is called informed financial consent and you can read more about it here.

Finally, you can talk to us. We’re all for giving members all the information they need before they go into hospital. It’s better for your pocket and your overall recovery. We’ll let you know what your health insurance will cover and any other costs you can expect (like your excess if you have one).

We can also give you a heads-up about the other benefits and programs available to you as a TUH member designed to help you get back to fully operational as soon as possible.

Helpful resources

About out-of-pocket costs from PrivateHealth.gov.au

Informed Financial Consent from the Australian Medical Association